Open a Corporate Bank Account in UAE

Evolve Makes Opening A Bank Account Fast and Simple

Establishing a corporate bank account in the UAE is a critical step for your business operations, but navigating the complex banking landscape can be challenging. At Evolve Consultancy, we provide comprehensive bank account opening services tailored to your business needs, ensuring a smooth, efficient process while meeting all regulatory requirements. Our expert team has established strong relationships with leading UAE banks, enabling us to expedite your application and increase approval rates.

We assess your business profile, requirements, and banking needs to identify the most suitable banking options for your specific business structure.

Our team assists in preparing and organizing all required documentation, ensuring compliance with the latest banking regulations and KYC requirements.

We leverage our established relationships with UAE's leading banks to introduce your business and facilitate direct communication with banking officials.

We handle the complete submission process, ensuring all forms are correctly filled out and submitted with proper supporting documentation.

Our team actively follows up with the bank, addresses any additional requirements, and ensures a smooth activation of your corporate bank account.

Setup corporate accounts with the UAE's established local banks offering comprehensive banking services tailored to the local market.

Access accounts with international banks operating in the UAE, providing global banking solutions and multi-currency capabilities.

Setup accounts with innovative digital banks offering streamlined, paperless banking experiences with advanced online platforms.

Connect with specialized banking services focused on wealth management, investments, and capital growth opportunities.

With years of experience in UAE's corporate banking landscape, our team brings specialized expertise that significantly enhances your chances of account approval.

At Evolve Consultancy, we've refined the bank account opening process into a streamlined journey, guiding businesses efficiently through each stage with expert assistance.

We assess your business profile and banking needs to recommend the most suitable options for your specific requirements.

Our experts help you compile and organize all necessary documents according to specific banking requirements.

We leverage our established banking relationships to introduce your business and arrange meetings with key banking officials.

We handle the complete submission process, ensuring all forms are correctly filled and submitted with proper supporting documentation.

While the bank processes your application, we actively track progress and address any additional documentation requests promptly.

Upon approval, we coordinate with the bank to finalize account setup and arrange for necessary signatories and documentation.

We assist with the final stages of account activation, including online banking setup and initial transactions guidance.

This timeline represents an optimized scenario for corporate bank account opening with our assistance. Actual timeframes typically range from 2-8 weeks and may vary significantly based on factors including: business type and activities, nationality of shareholders and directors, selected banking institution, documentary requirements, regulatory changes, and enhanced due diligence processes. Our consultants will provide you with a personalized timeline assessment during your initial consultation.

Through our partnerships with leading UAE banks, we connect your business with state-of-the-art banking solutions designed for today's digital economy. We help you navigate and select the most beneficial features for your specific business needs.

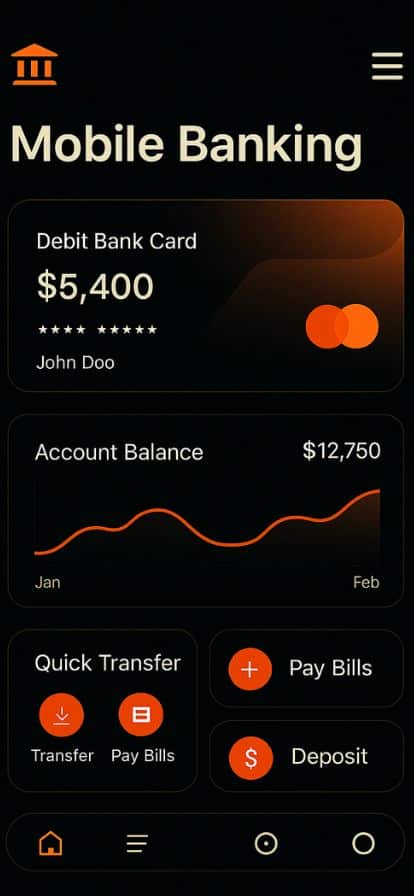

Access to cutting-edge mobile banking applications with comprehensive business features, allowing you to manage your finances anytime, anywhere.

We help you set up multi-currency accounts to facilitate international business operations with minimized conversion fees and competitive exchange rates.

Our banking partners implement advanced security protocols to protect your business finances with multi-layered authentication and fraud prevention systems.

Access to financial analytics and reporting tools that provide valuable insights into your business cash flow, helping you make informed financial decisions.

We help you connect with integrated payment gateways and processing solutions that streamline your business operations and improve cash flow management.

Through our connections, we help establish direct relationships with dedicated banking managers who understand your business needs and provide personalized support.

Today's corporate banking goes beyond traditional services. We ensure you gain access to mobile and digital banking platforms that offer powerful tools designed specifically for businesses operating in the UAE.

Facilitate instant domestic transfers and scheduled international payments through secure mobile platforms.

Access your business accounts through advanced biometric authentication for enhanced security.

Set up customizable permission levels for different team members with comprehensive audit trails.

Submit and manage banking documents digitally without visiting physical branches.

Features may vary between banking institutions. Our consultants will help identify and recommend banks offering mobile solutions that best match your business requirements.

At Evolve Consultancy, we handle the entire UAE bank account opening process on your behalf. Our specialists manage all documentation, bank communication, and application procedures, allowing you to focus on your business while we navigate the complexities of the UAE banking system.

Our bank account opening service is designed to remove the burden from business owners by handling all aspects of the process. We don't offer tiered packages because we believe every client deserves our full support through this critical business setup step.

You'll work with a dedicated consultant who oversees your entire account opening process from start to finish.

We leverage our established relationships with major UAE banks to increase approval chances and expedite applications.

Our team ensures all documentation meets strict UAE banking compliance requirements, reducing rejection risks.

We handle everything from initial consultation to account activation, providing updates throughout the process.

Find answers to common questions about corporate bank account opening in the UAE. Our expert team is available to address any specific inquiries not covered below.

The documentation requirements may vary slightly between banks, but typically include:

Our team helps you prepare and organize all required documentation according to the specific requirements of your chosen bank.

The timeframe for opening a corporate bank account in the UAE typically ranges from 2 to 8 weeks, depending on several factors:

With our assistance, the process is streamlined and carefully monitored to avoid unnecessary delays. We maintain regular communication with banking representatives to ensure your application progresses efficiently.

Yes, offshore companies can open bank accounts in the UAE, but the process is typically more stringent compared to mainland or free zone companies. Banks apply enhanced due diligence for offshore entities, requiring additional documentation and background checks.

Key considerations for offshore companies include:

Our consultants have experience with offshore company banking requirements and can advise on the most suitable banking options for your offshore structure.

Physical presence requirements vary by bank and depend on your company's structure:

Our team will advise you on the specific presence requirements for your chosen bank and can coordinate the account opening appointment at a time that best suits your schedule when you visit the UAE.

The UAE has numerous banks offering corporate services, each with different strengths. The "best" bank depends on your specific business needs, industry, transaction volumes, and international requirements.

Some factors to consider when selecting a bank include:

During our initial consultation, we assess your specific banking needs and recommend banking options that align with your business requirements, helping you make an informed decision.

Banks may reject corporate account applications for various reasons:

Our consultants help minimize rejection risks by thoroughly preparing your application, selecting appropriate banks based on your business profile, and ensuring all compliance requirements are met before submission.

Yes, a newly formed company can begin the bank account application process immediately after receiving its trade license and registration documents. However, some important considerations include:

Our services can be integrated with your company formation process, allowing us to prepare banking documentation simultaneously with your company setup to minimize delays between company registration and account opening.

After your account is successfully opened, we offer several ongoing support services:

Our relationship doesn't end when your account is opened. We remain available to provide ongoing support and ensure your banking experience in the UAE remains smooth and efficient.

Our banking experts are ready to provide personalized answers to your specific inquiries.